We all know that accidents happen, and writing off your vehicle is no exception. Many people wrongly believe that write-offs are only due to negligence or as a result of bad driving.

Insurers declare vehicles written-off for a number of reasons, many of which have nothing to do with your driving. Consider an accident where another driver crashes into your car through no fault of your own, or imagine your vehicle being stolen and not recovered, or finding that your vehicle has been maliciously damaged.

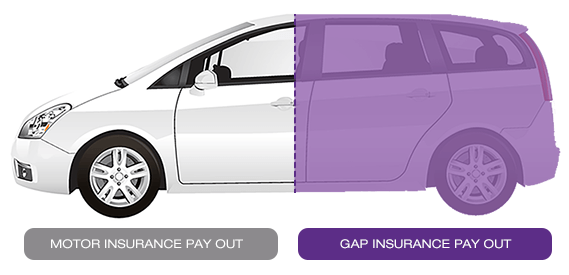

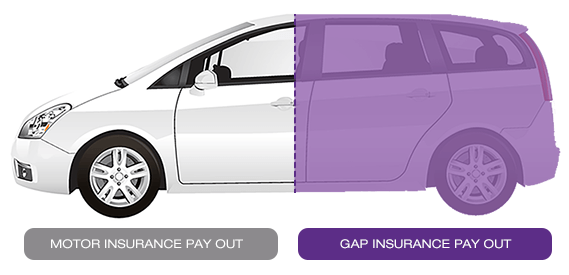

These are the very real risks that mean your insurer could declare your vehicle written-off, and because many insurers only pay out the price the vehicle was worth at the time of the incident, it's rarely the amount required for you to get back into an equivalent replacement.

Depreciation in value is unavoidable, and many cars will be worth as little as 40% of their original value after 3 years on the road*.

As an example, if you purchase a new car for £15,000 it will be worth roughly £6,000 after 3 years of being on the road. Imagine that your vehicle is involved in an accident, and declared written off by your insurer. They give you a cheque for the market value, which is £6,000 - and now you have to go out and purchase a replacement vehicle with that cheque. You may struggle to find an equivalent replacement vehicle with that amount, so you use savings or take out a loan to purchase a good equivalent.

However, as a Simons of Shropshire customer, if you take out Guaranteed Asset Protection (GAP) Insurance when you buy your vehicle you'll also receive a payment from the policy which bridges the financial gap and provides you with the difference between your motor insurance settlement and the amount you originally paid for the vehicle.

The Detail

However, as a Simons of Shropshire customer, if you take out Guaranteed Asset Protection (GAP) Insurance when you buy your vehicle you'll also receive a payment from the policy which bridges the financial gap and provides you with the difference between your motor insurance settlement and the amount you originally paid for the vehicle.

The Detail

However, as a Simons of Shropshire customer, if you take out Guaranteed Asset Protection (GAP) Insurance when you buy your vehicle you'll also receive a payment from the policy which bridges the financial gap and provides you with the difference between your motor insurance settlement and the amount you originally paid for the vehicle.

The Detail

However, as a Simons of Shropshire customer, if you take out Guaranteed Asset Protection (GAP) Insurance when you buy your vehicle you'll also receive a payment from the policy which bridges the financial gap and provides you with the difference between your motor insurance settlement and the amount you originally paid for the vehicle.

The Detail

- Works in tandem with your standard comprehensive motor insurance policy

- Policy terms up to 36 months

- Pays the difference between your insurers settlement, and the amount you paid for the vehicle, or the amount required to settle your finance agreement, whichever is greater

- Return to Invoice Advanced (RTIA) GAP will pay you back up to the purchase price of your vehicle (up to £25,000)

- It also covers your motor insurance excess up to £250.00

Used BMW

Used BMW Used MERCEDES-BENZ

Used MERCEDES-BENZ